Money math worksheets provide a valuable tool for educators and parents seeking to enhance children’s understanding of financial concepts. These worksheets offer a structured approach to learning about money, covering various topics like counting coins and bills, making change, budgeting, and calculating simple interest. They often incorporate real-world scenarios, making the learning process engaging and relevant for young learners. The use of visual aids and interactive exercises helps children grasp fundamental money management skills early on. Effective use of money math worksheets contributes significantly to a child’s financial literacy. Finally, the worksheets are adaptable to different age groups and learning styles.

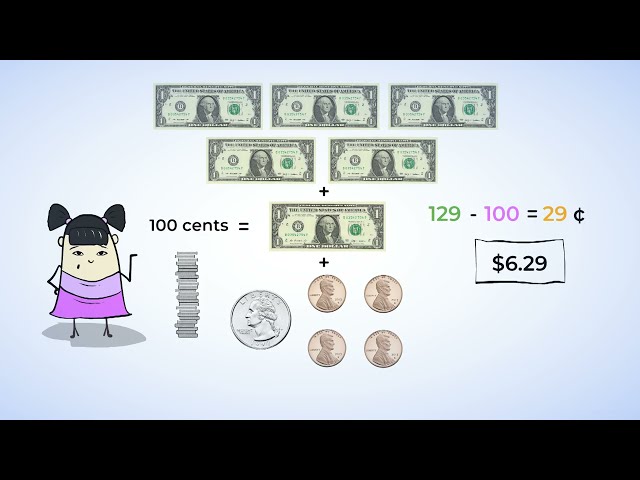

The design of money math worksheets typically involves a progression of difficulty, starting with basic counting and progressing to more complex calculations. They commonly feature colorful illustrations and engaging activities to maintain children’s interest and motivation. Many worksheets incorporate real-world scenarios such as shopping trips or saving for purchases to enhance comprehension and practical application. The accessibility of free printable money math worksheets online further broadens their reach and usefulness. Well-designed money math worksheets cater to diverse learning styles and can be effectively integrated into both home and classroom settings.

Furthermore, the effectiveness of money math worksheets is significantly impacted by the way they’re used. Regular practice and consistent engagement are essential for skill development. Teachers and parents should provide feedback and support to help children understand and correct their mistakes. Integrating the worksheets with other learning activities or real-life experiences can significantly reinforce learning. The value of money math worksheets extends beyond the immediate learning activity; it lays a solid foundation for responsible financial habits in the future. Finally, it’s important to adapt the worksheets to the child’s individual pace and learning style.

Utilizing Money Math Worksheets Effectively

Effective implementation of money math worksheets requires careful consideration of the child’s age and existing knowledge. Worksheets should be introduced gradually, beginning with simpler concepts before progressing to more complex ones. Regular practice is key to mastering the skills presented; consistent use helps reinforce concepts and build confidence. Providing positive reinforcement and encouragement throughout the learning process is crucial for maintaining motivation and engagement. The integration of these worksheets with real-life scenarios, such as managing allowance or planning a small purchase, can greatly enhance understanding and retention.

Moreover, adapting the worksheets to individual learning styles is essential. Some children may benefit from visual aids, while others may respond better to hands-on activities. Teachers and parents should monitor the child’s progress and adjust the difficulty level accordingly. Encouraging children to explain their reasoning and problem-solving strategies helps develop their critical thinking skills. Finally, the use of money math worksheets shouldn’t be limited to a solitary activity; integrating them into a broader financial literacy curriculum is more beneficial.

-

Determine the appropriate skill level:

Start with worksheets aligned with the child’s current understanding of numbers and basic math operations. Gradually increase the difficulty level as the child progresses.

-

Choose engaging worksheets:

Select worksheets with colorful visuals, interactive elements, and real-world scenarios to keep the child interested and motivated. A variety of worksheet types can maintain engagement.

-

Provide clear instructions and support:

Ensure the child understands the instructions before beginning the worksheet. Offer guidance and support as needed, but allow them to work independently as much as possible. Focus on the process, not just the answer.

-

Review and provide feedback:

Check the child’s work and provide constructive feedback. Focus on areas where improvement is needed and celebrate successes. Positive reinforcement is key to building confidence.

-

Integrate with real-world applications:

Connect the concepts learned in the worksheets to real-life situations, such as managing allowance or saving for a purchase. This makes the learning more meaningful and relevant.

Frequently Asked Questions About Money Math Worksheets

Money math worksheets serve as a foundational tool for developing essential financial literacy skills. Understanding the nuances of these worksheets, including their purpose, application, and limitations, is crucial for effective utilization. Addressing common questions about these resources helps to optimize their educational value and ensures their application aligns with individual learning styles and needs. Common questions often revolve around age appropriateness, the range of skills covered, and integration with broader learning objectives. Therefore, providing comprehensive answers to these frequently asked questions enhances the effectiveness of money math worksheets in achieving educational goals.

What age group are money math worksheets suitable for?

Money math worksheets are adaptable to a wide range of ages. Simple counting and identification worksheets are suitable for preschoolers, while more advanced worksheets involving budgeting, calculating interest, or understanding taxes are appropriate for older children and even teenagers. The key is to select worksheets that align with the child’s current mathematical abilities and understanding of financial concepts. Carefully assess the child’s understanding and adapt the material accordingly.

What are some of the key skills developed using money math worksheets?

Money math worksheets help develop a variety of crucial skills. These include counting and recognizing coins and bills, making change, calculating totals, understanding basic budgeting principles, and even learning about saving and investing at more advanced levels. They build foundational number sense and problem-solving skills applicable beyond just financial contexts. The worksheets offer a structured, hands-on approach to learning these crucial skills.

Where can I find free money math worksheets?

Numerous websites offer free printable money math worksheets, catering to various age groups and skill levels. A simple online search will reveal a wealth of resources. Educational websites, teacher resource sites, and even some commercial sites offer free printable worksheets. Ensure that the worksheets chosen align with educational standards and are appropriate for the target age group. The availability of free resources makes them accessible to a wider audience.

How can I make my own money math worksheets?

Creating your own money math worksheets allows for customization to specific learning needs and interests. Using simple word processing software or even drawing your own worksheets can be an effective approach. This provides the opportunity to focus on particular concepts or scenarios relevant to the child’s experience. Incorporate real-life examples and relevant scenarios that the child can relate to, enhancing their understanding and engagement.

The consistent use of money math worksheets contributes significantly to a strong foundation in financial literacy. The structured approach facilitates the development of essential mathematical skills. These worksheets provide a fun and engaging way for children to learn important life skills. Further, the wide availability of both free and commercially produced resources enhances accessibility. Overall, the positive impact on children’s understanding of money management is considerable.

Moreover, the adaptability of money math worksheets allows for personalization based on individual learning styles and needs. The progressive difficulty level encourages consistent progress. Regular use reinforces concepts and improves problem-solving abilities. Effective use fosters a positive attitude towards learning about money, leading to more responsible financial habits in the future. The benefits of consistent usage cannot be overstated.

Key Aspects of Money Math Worksheets

Money math worksheets serve as a fundamental tool in developing financial literacy. Their effectiveness hinges on several key factors. Careful selection and implementation are crucial for optimizing their educational impact. The benefits extend far beyond simply learning about money; they build essential problem-solving and critical thinking skills. Ultimately, the aim is to foster responsible financial behaviors from a young age.

Skill Progression

Worksheets should build upon previously learned skills, gradually increasing in complexity. This ensures a smooth learning curve and prevents frustration. This progressive approach is crucial for maintaining engagement and encouraging continued learning. The curriculum should be designed with a clear progression in mind, moving from basic to advanced concepts gradually.

Real-World Application

Integrating real-world scenarios into worksheets makes the learning more relevant and engaging. Examples of everyday financial transactions help children apply their skills to practical situations. The worksheets should bridge the gap between theoretical knowledge and practical application. Real-life examples increase understanding and retention.

Engaging Format

Using visual aids, interactive elements, and varied activities can keep children motivated and interested. A visually appealing and engaging format is crucial for maintaining student participation. Colorful visuals and interactive elements make the learning process more enjoyable and less daunting. The format should be appealing to a diverse audience.

Regular Practice

Consistent practice is essential for mastering the skills presented. Regular use reinforces concepts and builds fluency. Regular practice is essential for solidifying skills and increasing confidence. Consistent review and practice will ensure mastery of the subject matter. The importance of regular review can’t be overstated.

The above key aspects highlight the importance of a well-structured approach to using money math worksheets. Each aspect plays a significant role in optimizing the learning process. Careful consideration of these aspects ensures that children develop a thorough understanding of financial concepts and build a solid foundation for future financial literacy. The combined effect of these elements is paramount for successful learning.

In conclusion, the successful use of money math worksheets hinges on a thoughtful and strategic approach. They serve as an invaluable tool, building essential numeracy skills and promoting financial understanding from a young age. Effective implementation maximizes their potential, cultivating crucial life skills that extend far beyond the worksheet itself. A well-rounded approach incorporates various elements to maximize learning outcomes.

Tips for Effective Use of Money Math Worksheets

Maximizing the benefits of money math worksheets requires a structured and engaging approach. Teachers and parents should actively participate in guiding children through the learning process. The focus should extend beyond simply completing the worksheets; fostering an understanding of the concepts is paramount. This approach ensures the long-term effectiveness of the worksheets and promotes the development of sound financial literacy.

By following best practices, the educational potential of money math worksheets is significantly enhanced. A collaborative learning environment fosters both engagement and comprehension. Creating a supportive and encouraging atmosphere is crucial for the success of this educational tool. The emphasis should be on understanding the concepts rather than solely focusing on achieving correct answers.

Start with the Basics:

Begin with age-appropriate worksheets that focus on fundamental concepts, gradually increasing the difficulty as the child progresses. This structured approach prevents frustration and ensures a smooth learning curve. Ensure the child has a strong grasp of basic math before introducing more complex financial concepts.

Use Real-World Examples:

Connect the exercises to real-life situations to make the learning more relevant and engaging. This enhances comprehension and helps children apply their skills to practical scenarios. Relating the concepts to everyday experiences promotes better understanding and retention.

Make it Fun:

Incorporate games and interactive activities to keep the child motivated and interested. This transforms learning into an enjoyable experience, improving comprehension and retention. Gamification can significantly improve engagement and learning outcomes.

Provide Positive Reinforcement:

Offer encouragement and praise to boost the child’s confidence and motivation. Positive feedback reinforces learning and encourages continued effort. Celebrating successes helps build self-esteem and strengthens positive learning associations.

Review and Discuss:

Review the completed worksheets together, discussing the concepts and addressing any misconceptions. This ensures a thorough understanding of the material and identifies areas needing further attention. Open discussions help solidify learning and address potential misunderstandings.

Incorporate Practical Application:

Give children opportunities to apply their knowledge in real-world scenarios, such as managing allowance or planning a small purchase. This bridges the gap between theoretical learning and practical application. Hands-on experience strengthens the link between theory and practice.

The consistent and strategic use of money math worksheets helps children develop valuable financial skills. These skills extend beyond simple arithmetic; they contribute significantly to responsible money management. The effective use of these resources plays a significant role in shaping future financial behaviors. The long-term benefits of incorporating these resources into a child’s education are substantial.

Moreover, the adaptable nature of money math worksheets ensures they can be tailored to individual learning styles and needs. The availability of numerous resources ensures access for a wide range of learners. Ultimately, the goal is not just to complete the worksheets but to foster a genuine understanding of financial concepts and responsible financial habits. The successful integration of these worksheets into a comprehensive financial literacy plan is essential.

In conclusion, money math worksheets represent a powerful tool for cultivating financial literacy in children. Through careful selection, thoughtful implementation, and consistent engagement, these resources can significantly contribute to the development of valuable life skills and responsible financial behaviors. The continued use and adaptation of these tools are essential for ensuring positive outcomes.

Youtube Video: