A loan amortization worksheet Excel is a powerful tool for visualizing and managing loan repayments. It provides a detailed breakdown of each payment, showing how much goes towards principal and interest over the life of the loan. This allows borrowers to easily understand their loan’s terms and track their progress. These worksheets can be customized to reflect various loan parameters, offering valuable insights into financial planning. Understanding the amortization schedule is crucial for effective debt management and responsible borrowing. Finally, the ability to easily manipulate variables within the spreadsheet enables scenario planning and informed decision-making.

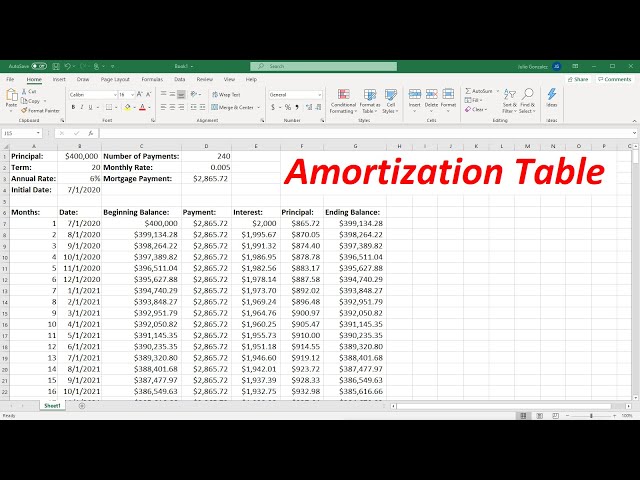

A loan amortization worksheet Excel facilitates a clear understanding of loan repayment schedules. By inputting key loan details like principal amount, interest rate, and loan term, the worksheet automatically calculates the monthly payment, total interest paid, and the remaining balance after each payment. This level of detail empowers borrowers to budget effectively and make informed decisions about their finances. A well-designed worksheet allows for the easy comparison of different loan options. Further, the visual representation of the amortization schedule provides a more intuitive understanding than simply viewing figures. This clarity contributes to responsible financial planning and reduces the risk of financial strain from unexpected repayment amounts.

Using a loan amortization worksheet Excel offers significant advantages. The ability to easily manipulate variables, such as interest rates or loan terms, allows for “what-if” scenarios, aiding in informed decision-making. A user can see how changes in these parameters would impact the monthly payment and total interest paid over the life of the loan. This feature is especially beneficial during loan comparisons. Finally, the transparency provided by the worksheet fosters a greater understanding of personal finances and responsible borrowing practices.

Understanding Loan Amortization Worksheets in Excel

Loan amortization schedules, especially those generated by an Excel worksheet, break down loan payments into their principal and interest components. This detailed view allows for a clear understanding of how much of each payment is applied to reducing the loan’s principal balance and how much contributes to the lender’s interest. By tracking these components over time, borrowers can gain insights into the overall cost of their loan. The use of Excel further facilitates the ability to easily adjust variables and see the resulting impact on payment amounts and the total interest paid. This capability is critical in comparing loan offers and making informed borrowing decisions.

The flexibility of an Excel-based loan amortization worksheet also allows for the incorporation of additional factors, such as prepayments or extra payments. This feature enables borrowers to explore the potential for reducing the loan’s overall term and interest cost. The visual representation of the amortization schedule in Excel further enhances comprehension, enabling borrowers to easily track their progress and understand the dynamics of loan repayment. This clarity and control significantly contribute to better financial management.

-

Input Loan Details:

Begin by entering the necessary loan information into the worksheet. This typically includes the loan amount (principal), annual interest rate, loan term (in years or months), and the start date of the loan. Accurate data input is crucial for generating an accurate amortization schedule. Ensure that the interest rate is entered as a decimal (e.g., 5% should be entered as 0.05). Double-check all figures before proceeding to avoid errors in the calculation.

-

Calculate Monthly Payment:

Most loan amortization worksheets have a formula or function to calculate the monthly payment automatically. This calculation is based on the standard loan amortization formula, which considers the principal, interest rate, and loan term. It’s important to understand how this formula works to better interpret the results and make necessary adjustments if needed. Excel offers built-in functions to simplify this step.

-

Generate Amortization Schedule:

Once the monthly payment is calculated, the worksheet will generate an amortization schedule. This schedule typically lists each payment, the payment date, the interest portion of the payment, the principal portion of the payment, and the remaining balance after each payment. The visual representation of this data allows for easy tracking and analysis of the loan repayment progress. Ensure the schedule clearly displays all essential information in a user-friendly format.

Frequently Asked Questions about Loan Amortization Worksheets in Excel

Frequently, questions arise concerning the creation and usage of loan amortization worksheets in Excel. Users often seek clarification on the accuracy of calculations, the handling of extra payments, and the interpretation of the resulting amortization schedule. Understanding the limitations and capabilities of these worksheets is key to utilizing them effectively for financial planning and loan management. Addressing these common questions enhances the user experience and promotes responsible financial decision-making. The information provided below aims to clarify any uncertainties and encourage confident use of these valuable tools.

What formulas are used in a loan amortization worksheet Excel?

Loan amortization worksheets in Excel primarily utilize the PMT function to calculate the monthly payment. This function takes the interest rate, loan term, and principal as inputs. Additional formulas are then used to calculate the interest and principal portions of each payment, along with the remaining balance. These formulas are generally built into the worksheet design and are not usually directly interacted with by the user. However, understanding the underlying mathematical logic behind the calculations is beneficial for confirming accuracy and troubleshooting any potential issues. These formulas ensure the accurate calculation and presentation of the repayment schedule.

Can I adjust the payment amount in a loan amortization worksheet Excel?

Yes, you can typically adjust the payment amount in an Excel-based amortization worksheet. However, changing the payment amount will alter the overall loan term and the total interest paid. The worksheet will recalculate the amortization schedule accordingly, showing the impact of the adjusted payment on the repayment timeline. This feature allows for exploration of “what-if” scenarios, considering the financial implications of different payment strategies. This flexibility enhances the worksheet’s value for strategic financial planning. Experimenting with different payment amounts helps users understand the trade-offs between payment size and the loan’s overall duration.

How accurate are the calculations in a loan amortization worksheet Excel?

The accuracy of calculations in a properly constructed loan amortization worksheet Excel depends on the accuracy of the input data. If the loan amount, interest rate, and loan term are correctly entered, the calculations performed by the worksheet should be highly accurate. It’s crucial to double-check all input values to avoid errors. Errors in data entry can result in inaccuracies in the calculated amortization schedule. Therefore, careful input and verification are essential for ensuring reliable financial planning information.

The benefits of using a loan amortization worksheet Excel extend beyond simple repayment schedule tracking. It’s a valuable tool for financial planning and understanding the intricacies of loan repayments. The flexibility to adjust variables and visualize the impact enhances its practicality. The clarity provided by these worksheets empowers users to make informed financial decisions.

By utilizing this tool effectively, borrowers gain a greater understanding of their debt obligations, fostering responsible financial management. This enhanced awareness contributes to better budgeting, minimizing the risks associated with unexpected repayment amounts or unforeseen financial strains.

These worksheets offer a crucial advantage in facilitating comparisons between loan options. By inputting different loan parameters, users can quickly see the differences in monthly payments, total interest paid, and repayment timelines. This comparative analysis empowers borrowers to choose the most suitable loan option based on their financial situation and goals.

Key Aspects of Loan Amortization Worksheets

Understanding the key aspects of these worksheets is crucial for effective financial planning. The ease of use and customizable features provide substantial advantages in managing debt and exploring different repayment scenarios. Accurate data input is essential for reliable results, making careful data entry a crucial aspect of using these worksheets. The clear visual representation of the repayment schedule greatly aids in understanding the complexities of loan repayment.

Data Input Accuracy

Accurate data entry is paramount; errors can lead to inaccurate projections of loan repayments. Double-checking all input valuesprincipal, interest rate, and loan termis crucial for ensuring reliable results. The precision of the input data directly translates into the accuracy of the resulting amortization schedule. Using a spreadsheet program like Excel necessitates careful input. Errors in data entry can significantly impact the accuracy of the final calculations and lead to faulty financial planning.

Visual Representation

The clear visual representation of the amortization schedule is a major benefit. This clear, organized display of repayment information is essential for understanding how each payment is allocated between principal and interest. This visual clarity significantly contributes to a better understanding of the loan repayment process. Users can easily track their repayment progress and visualize their financial obligations throughout the loan’s term. The visual representation enhances the overall usability and understanding of the loan amortization schedule.

Flexibility and Customization

The ability to adjust variables, such as extra payments or changes in interest rates, offers flexibility and allows for “what-if” scenario planning. This feature is particularly valuable for evaluating different repayment strategies and anticipating potential financial impacts. The ability to customize the worksheet to reflect different loan terms and conditions further enhances its utility and versatility. This adaptability increases the worksheet’s value in making informed financial decisions.

Scenario Planning

The capability to explore different repayment scenariossuch as early repayment or changes in interest ratesis a significant advantage in financial planning. This allows for strategic decision-making, optimizing repayment strategies, and minimizing total interest costs. This foresight reduces financial risk and enhances financial control. The ability to project various scenarios is crucial in effectively managing personal finances.

By leveraging these aspects, borrowers can make informed financial choices, optimize their repayment plans, and improve their understanding of loan repayment dynamics. Understanding these key features is essential for effectively utilizing loan amortization worksheets.

The comprehensive nature of these worksheets makes them invaluable tools for both individual borrowers and financial professionals alike. The ability to visualize, analyze, and manipulate loan repayment data facilitates sound financial decisions. The combination of mathematical accuracy and user-friendly design makes these worksheets exceptionally useful for managing personal finances.

Tips for Using Loan Amortization Worksheets in Excel

Maximizing the utility of a loan amortization worksheet Excel requires understanding several key tips. These range from ensuring data accuracy to effectively utilizing the worksheet’s features for financial planning. These tips promote efficient use of this valuable tool and better financial management. Proper usage significantly enhances the efficacy of these worksheets.

Following these guidelines will result in an accurate and informative analysis of loan repayment scenarios. Understanding these best practices ensures the effective utilization of this helpful tool. By applying these tips, individuals can enhance their financial planning and decision-making processes.

Always Double-Check Input Data:

Accuracy is paramount. Ensure all inputted loan informationprincipal, interest rate, loan termis correct before generating the amortization schedule. Inaccurate data leads to flawed results. Careful data entry is crucial for reliable financial planning. Reviewing the entered data thoroughly prevents errors in the generated schedule.

Utilize Excel’s Built-in Functions:

Excel offers functions specifically designed for financial calculations, including loan amortization. Using these functions ensures accuracy and reduces the likelihood of manual calculation errors. Leveraging Excel’s capabilities optimizes efficiency and accuracy. Utilizing these functionalities facilitates quick and accurate calculations.

Explore “What-If” Scenarios:

Manipulate loan parameters (interest rate, loan term, extra payments) to see the impact on the repayment schedule. This allows for comparison of different options and informed decision-making. This flexibility aids in finding the most suitable repayment strategy. Experimenting with different scenarios enhances understanding of loan repayment dynamics.

Use Data Visualization Techniques:

Visualizing the amortization schedule using charts and graphs can make it easier to understand the repayment process. Excel provides tools for creating various visual representations. Visual aids enhance comprehension and improve decision-making. Graphical representations provide a clearer overview of loan repayment.

Regularly Review and Update the Worksheet:

As your financial situation changes, update the worksheet accordingly. This ensures the accuracy of your financial projections. Keeping the worksheet up-to-date facilitates ongoing financial planning. Regular review and updating maintain the relevance of the data.

By understanding and employing these tips, users can fully leverage the power and potential of a loan amortization worksheet Excel. The effective use of these worksheets contributes significantly to informed financial decision-making and sound personal finance management.

Mastering the use of a loan amortization worksheet Excel empowers users to gain a deeper understanding of their loan repayments and make informed financial choices. The ability to easily visualize and manipulate different variables allows for effective planning and the exploration of various repayment strategies.

In conclusion, the capabilities of these worksheets extend far beyond a simple repayment schedule. They serve as essential tools for financial planning, offering valuable insights and empowering users to make well-informed decisions regarding their loans. The combination of computational power and user-friendly design makes these worksheets extremely useful in managing personal finances.

Ultimately, proficient use of a loan amortization worksheet Excel leads to better financial management and informed decision-making regarding loan repayment. It’s a powerful tool for visualizing financial obligations and planning for a debt-free future.

Youtube Video: